Dec 2, 2020

Controlled Environment Agriculture: Growing Beyond the Hype

Image sourced from S2G Ventures

WRITTEN BY: SANJEEV KRISHNAN, S2G VENTURES

As 2020 draws to a close, we continue to be reminded that we are in a moment of unprecedented significance. Covid deaths passed 1.34M globally. The effects of climate change were seen across the globe and from coast to coast in the United States. The dual impacts of the coronavirus and climate change have had far reaching implications to our food system - from consumers, to retailers, across the supply chain and back to farmers and producers.

The urgency to innovate has never been more apparent. And with the right technologies, incentives and partnerships, our future food system can provide healthy food for all people and mitigate the effects of climate change.

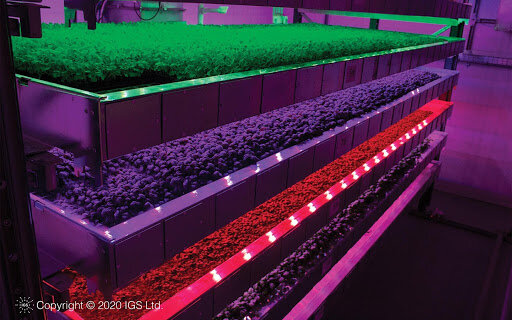

Controlled Environment Agriculture, including greenhouse and indoor production, is a small, but high-potential part of this future food system. CEA comes in many forms, each offering a unique element to improve supply chain resiliency, quality and safety, and fill a present gap in supply within the produce category. It is a growing part of our evolving food system and can work alongside outdoor production to mitigate climate risk and help solve systemic nutrition and food access challenges.

The value propositions of CEA have been recognized by food and ag stakeholders, with local and urban controlled production receiving private investment to the tune of $2.0B across North America and Europe, emphasis in the 2018 Farm Bill, and interest from corporations across the supply chain.

Over the last few months, our team at S2G Ventures conducted desktop research and interviews with over 20 industry experts including CEA growers, systems providers, policymakers, academic institutions, outdoor growers, ag input suppliers, philanthropists, and other investors to gain a perspective on the growing CEA market. Our report Growing Beyond the Hype: Controlled Environment Agriculture predicts that the maturation of CEA will lead to differentiated, quality products, cost-competitive pricing and a more resilient, traceable and trustworthy supply chain.

Image sourced from S2G Ventures

Local production and controlled environments will lead to a more resilient, traceable and trustworthy supply chain.

Despite being a $1.2 trillion global industry, fresh produce faces significant supply and demand challenges resulting in a systemic lack of high-quality, affordable products reaching consumers. According to the Lancet, only 36% of the global population in 2015 had adequate availability of fruits and vegetables to meet the WHO age-specific minimum nutrition targets.

In the United States, for example, the fresh produce market is challenged by the limitations of outdoor production, including climate, field loss exposure, resource intensiveness, and limited ability to iterate or diversify, as well as geographic constraints resulting in products traveling 7 - 10 days on average from farm to consumer. As a result, the U.S. is reliant on other countries to meet demand with 53% of fresh fruit and 32% of fresh vegetables imported annually according to the FDA.

If just 13% of vegetables and herbs shift to local CEA production by 2025, the United States can add $2.3bn additional production capacity and reduce our need for fresh vegetable imports by 15%. Local production can save up to 9 Trillion food miles through shorter transportation routes minimizing shelf life time spent in transit and reducing the amount of food waste by retailers and consumers. Additionally, controlled environments improve food safety, traceability and consistency of production.

Image sourced from S2G Ventures

Technology and operations advancements drive improvements to CEA unit economics that can compete with or beat outdoor production.

In order to gain market share, CEA production must become cost competitive with outdoor production. High upfront capex costs of facilities and equipment as well as energy costs, labor and product inputs, have historically made costs of scaled CEA growing prohibitive. But innovation of grow inputs, improved grow systems, and optimization of facility productivity are driving more cost-effective production. Those innovations combined with CEA’s higher number of grow cycles, 10+ for Greenhouse and 20+ for Indoor, will enable CEA to achieve unit economics that are at cost parity with outdoor.

Image sourced from S2G Ventures

CEA will usher in the next wave of biodiversity, nutrient density, and flavor innovation providing retailers with differentiated, quality products.

According to the UN’s Food and Agriculture Organization, about 75 percent of the world's food comes from just 5 animal species and 12 plants. Almost half of our plant-derived calories come from just three foods: wheat, corn and rice. Germplasm for these plants are bred for long storage time and disease resistance, at the expense of flavor, color, and nutritional value. The lack of biodiversity and nutritional value in our global diet restricts the value that plant molecules can play in human health.

Indoor Agriculture offers new grow formats, methods and technologies that promise to increase the quality, consistency and diversity of produce. Advancements in CEA-tailored seeds bred for traits such as flavor, color, nutrient density and ripening will expose consumers to new flavors and more varied products. Ultimately, indoor agriculture will support customized grow recipes as IP, branded produce, local production of hard to access speciality ingredients, spices and superfoods and eventually inputs for food as medicine.

Market Potential

With increased demonstration of the viability of controlled growing and ability to address current supply challenges, we predict CEA will grow 5x in US market share over the next 10 years.

Greenhouse production is already significant and growing - driven by Increasing demand for organic produce. The North American greenhouse fruits and vegetable market is growing at 20%+ annually and globally Greenhouse production is scaled to 100B sq ft.

Image sourced from S2G Ventures

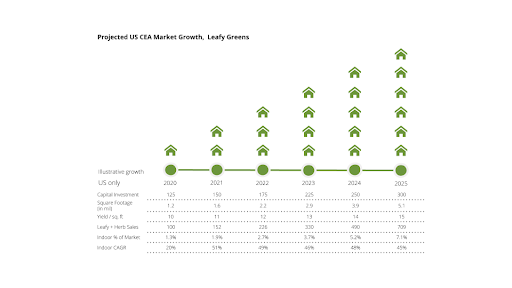

We project growth in the leafy greens category – where indoor agriculture could become >10% of sourced product by 2025 – and be complemented by berry and other vegetable innovation in greenhouse, vertical indoor, and container formats. More broadly, we predict CEA will support >10% of US vegetable and herb production by 2025.

Achieving Market Leadership

But what does it take for indoor growers to achieve success in this high potential industry? Getting products on the shelf at small quantities is not the challenge; getting retailer reliance on indoor at scale is the next goal as indoor players build capacity.

If scaled production generates long-term viability, various approaches can be deployed to build a winning CEA platform. While complementary and dependent on numerous factors, such as access to capital, differentiating in cost to produce, productivity or the catalog of products will increase the chance of grower success.